The Bangladesh government needs to take good care of Japanese companies operating here to attract more foreign direct investment (FDI) from the island country as many business entities are waiting to bring in investment, said Japanese Ambassador to Bangladesh ITO Naoki yesterday.

Currently, 310 Japanese companies are operating in different sectors in Bangladesh. Very often they complain about not getting the same facilities provided to local companies by the government.

For instance, when the government disburses any loan facility or cash incentives on export, foreign companies do not enjoy the same benefits enjoyed by the local companies.

“We have a long list of Japanese companies that have already invested in Bangladesh and many are waiting to invest here,” Naoki said.

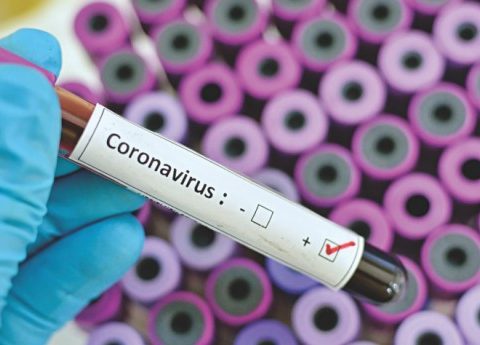

He was addressing a virtual meeting on “Implications of COVID-19 on FDI inflow to Bangladesh: Challenges and Way Forward” organised by the Dhaka Chamber of Commerce and Industry (DCCI).

“The level of interests by Japanese companies to invest in Bangladesh has not been changed. They are ready to come to Bangladesh for investment.”

The ambassador also said some 55 per cent of Japanese FDI was received by 10 members of the Association of South-East Asian Nations (ASEAN) while of the total FDI, Bangladesh received only 0.09 per cent last year.

Easing the business terms and conditions for Japanese companies, bringing about regulatory reforms and taking good care of the existing Japanese companies are needed for attracting more Japanese investment here.

The Japanese envoy also said it is important to turn the special economic zone (SEZ) for Japanese investors in Araihazar in Narayanganj into the number one zone in Asia and an important zone from among those in ASEAN countries.

Outward investment by Japanese investors declined 33 per cent year-on-year to $113 billion between January and June this year because of the coronavirus pandemic, said Yuji Ando, country chief of Japan External Trade Organisation.

That indicates that the companies are struggling to survive incurring losses in this situation, he said.

Japanese investors always complain about the tax and business environment issues in Bangladesh. Ando said motorcycle production is a very important sector for investment by Japanese investors in Bangladesh.

Currently, some 5,00,000 motorcycles are produced here in Bangladesh, he said, adding that the number could be increased a lot as the demand is there.

Almost all big US companies have their operations in Bangladesh and many more were interested to invest here, said JoAnne Wagner, deputy chief of mission of the US Embassy in Bangladesh.

Agricultural food processing industries are very interesting areas of investment in Bangladesh for American investors.

Labour rights improvement, safety and corruption are issues of concern for US investment in Bangladesh, she added.

Immediate reforms are needed in customs and transfer of profit by the foreign companies and curbing corruption for bringing more FDI, said Paban Chowdhury, executive chairman of the Bangladesh Economic Zones Authority (BEZA).

Although China allowed duty-free access to 97 per cent of Bangladeshi goods, the value addition by Bangladesh needed to be 40 per cent.

“So it might not be very simple and easy to enjoy the full benefits from the Chinese duty exception offer.”

The country also needs more seaports, Chowdhury said, while citing Vietnam’s 44 seaports to further his point.

“We need a congenial business environment,” said Syed Ershad Ahmed, president of the American Chamber of Commerce in Bangladesh (AmCham).

Sometimes, the contradictory policies of industries and commerce ministries affect the business.

“Sometimes, we are harassed by the National Board of Revenue. Protection of intellectual property rights and port management are very important issues for Bangladesh now,” Ahmed added.

Vietnam received the highest amount of FDI from Japan, said Abul Kasem Khan, chairman of the Business Initiative Leading Development (BUILD).

“China’s duty-free offer can be a game-changer for Bangladesh in case of attracting FDI.”

Fast-tracking of the special economic zones is needed and Bangladesh needs to invest $300 billion for improving its infrastructure, he added.

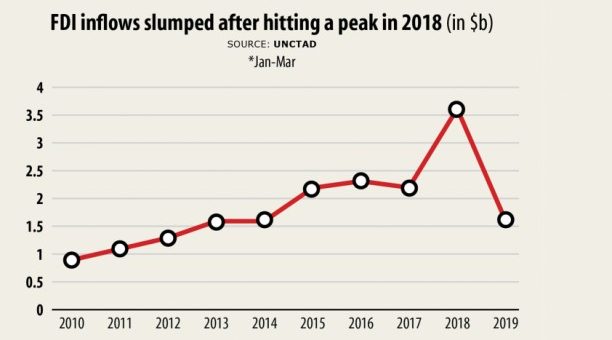

While presenting a keynote paper, M Masrur Reaz, chairman of Policy Exchange, said the global FDI, according to the United Nations Conference on Trade and Development, would plunge 40 per cent in 2020 and by another 5 per cent to 10 per cent in 2021.

Global FDI will fall short of the $1 trillion-mark for the first time since 2005. Moreover, developing countries of Asia may face lower investment flows of up to 45 per cent, he said.

Bangladesh needs to improve in a few areas for gaining competitiveness like innovation, infrastructure, market efficiency, technological readiness and business sophistication.

“We have a $350 billion investment gap in infrastructure. Private investment to GDP ratio should be 26.6 per cent.”

However, Bangladesh has been maintaining impressive economic performances and high potential to get better FDI inflow.

Bangladesh has many strengths for foreign investors to leverage like high growth rate, sound macro-economic management, demographic dividend, liberal policies, strategic geographic location, affordable and flexible labour market and preferential market access.

But to woo more FDI, some critical areas need focus such as compliance, skilled labour force, easy cross-border movement of goods and coherence between trade and investment policies.

To improve the investment climate, Reaz suggested policy actions and reforms like access to finance, regulatory reforms, a faster pace of mega infrastructure development, simplification of the tax regime, developing FDI policy and export diversification.

The FDI to GDP ratio in Bangladesh is 1.2 per cent, which is less than that of India, Sri Lanka, Vietnam and Cambodia, said DCCI President Shams Mahmud, while moderating the discussion.

Out of the total FDI stock, the country received the highest $3.8 billion FDI in gas and petroleum sector where the US is the largest investor with $3.6 billion, followed by the UK, South Korea, the Netherlands, China and Japan.

Fast customs clearance facility is more important for investors, said Ruhul Alam Al Mahbub, managing director of Samsung-Fair Distribution.

Infrastructure development, building confidence among local investors, policy consistency, removal of bureaucracy and political stability were key to attracting FDI, he added.

Land registration is an important issue that needs to be addressed, said ASM Mainuddin Monem, deputy managing director of Abdul Monem.

He emphasised on better coordination among the BIDA, BEZA and land ministry and called for a congenial policy regime that ensures a level playing field for private economic zone owners.

The pandemic would open up opportunities of foreign investment relocation, Monem added.

Investment needs to be encouraged in the energy and infrastructure sectors, said Asif Ibrahim, chairman of the Chittagong Stock Exchange and a former DCCI president.

The government’s plan of establishing 100 SEZs will boost FDI. Public-private partnerships and resolving the policy constraints will lead to a newer height.

The recent move by the government to allow non-resident Bangladeshis to invest in mutual funds is a step in the right direction.

Terming the Bangla Bond a great initiative, he said such innovative ideas would help entrepreneurs raise funds.

A reduction of tax for investors would ease their arrival, but on the other hand, Bangladesh’s tax to GDP ratio is the lowest in the region, said Salman Fazlur Rahman, private industry and investment adviser to the prime minister.

“We need to widen our tax net to ease the burden on the existing taxpayers. We will reform the bankruptcy law and companies act soon,” he said.

The adviser said Japan has offered to modernise the Kamalapur Railway station to bring about a multimodal transportation system.

Rahman admitted petty corruption in government mechanisms and corruption in the political parties at the mid-level.

For instance, corruption has been taking place in land registration and while getting licences from different government offices, he said.