Essar sold Essar Oil to a group backed by Russian oil major Rosneft.

New Delhi:

Essar Group has asked Nayara Energy to pay about $350 million upfront for a brand licensing deal struck 5 years ago when Essar Oil was sold to the Russian-led group, instead of staggering the payment, sources familiar with the matter said.

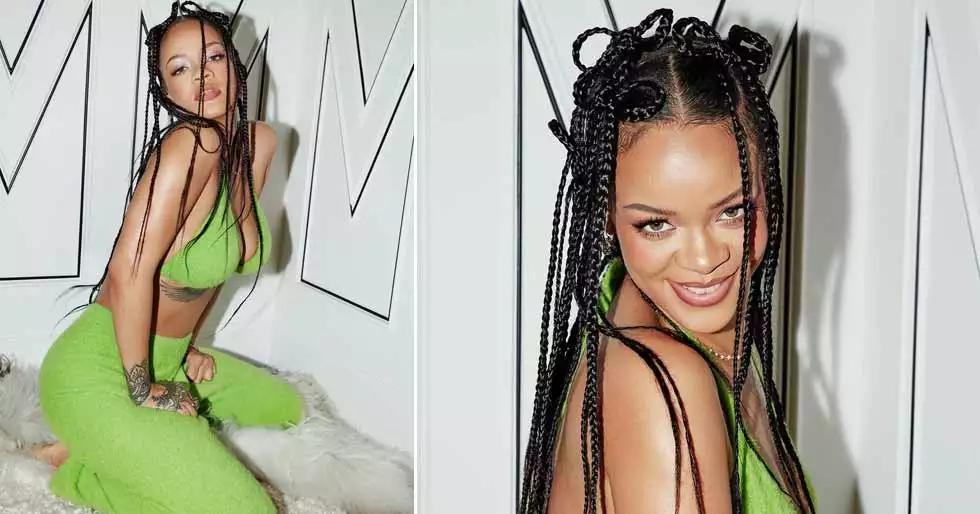

Essar, built by brothers Shashi and Ravi Ruia, sold Essar Oil to a group backed by Russian oil major Rosneft for about $13 billion in 2017 as part of efforts to raise funds to settle $25 billion which it owed to Indian banks.

At the same time Essar Oil, now known as Nayara Energy, and Essar affiliate Abhinand Ventures Pvt Ltd signed a 99 year deal which allowed Nayara to use Essar’s brand by paying an annual license fee of $32 million for 20 years and $1 for 79 years.

It also gave Abhinand Ventures a right to seek 15 years of license fee upfront, using some discounting after a 5-year lock-in period expired, the three sources told Reuters.

“There is a long-term brand agreement providing for payment of license fees for usage of the Essar brand by Nayara. Any payment by Nayara is merely discharge of an existing contractual obligation and is in (the) ordinary course of business,” an Essar spokesman said.

Nayara, which says it owns more than 6,000 fuel stations across India, did not respond to a Reuters request for comment.

Essar wants to clear its debt by December, after paying banks 90% of the amount owed to banks, the sources said.

Nayara, which posted a second quarterly profit in July-September through its processing of discounted Russian oil and fuel exports, is expected to complete the payment to Abhinand Ventures this month, the sources added.

Essar, with an annual revenue of $15 billion, also wants to use the funds to decarbonise its assets including the 10 million tonnes per annum (mtpa) Stanlow refinery, a planned blue hydrogen production hub in Britain, an iron ore mine and pellet project in the United States, a 20 mtpa port and a power plant in western India.

In next few days Essar hopes to get $2.4 billion through the sale of a port and power plant to a ArcelorMittal Nippon Steel Ltd (AM/NS), that acquired its steel plant in 2019.

“Our aim is to settle our debt by the end of this year and invest in clean businesses and digitisation,” the Essar spokesman said.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Featured Video Of The Day

Sensex Surges Over 1,150 Points As Global Risk Sentiment Improves